Learn about Prefabricated Homes

Outline:

– Understanding prefab: definitions and types

– Cost, timeline, and quality

– Design, materials, and energy performance

– The process: land, permits, logistics, and inspections

– Ownership: financing, insurance, resale, and maintenance

What Prefabricated Homes Are: Definitions and Types

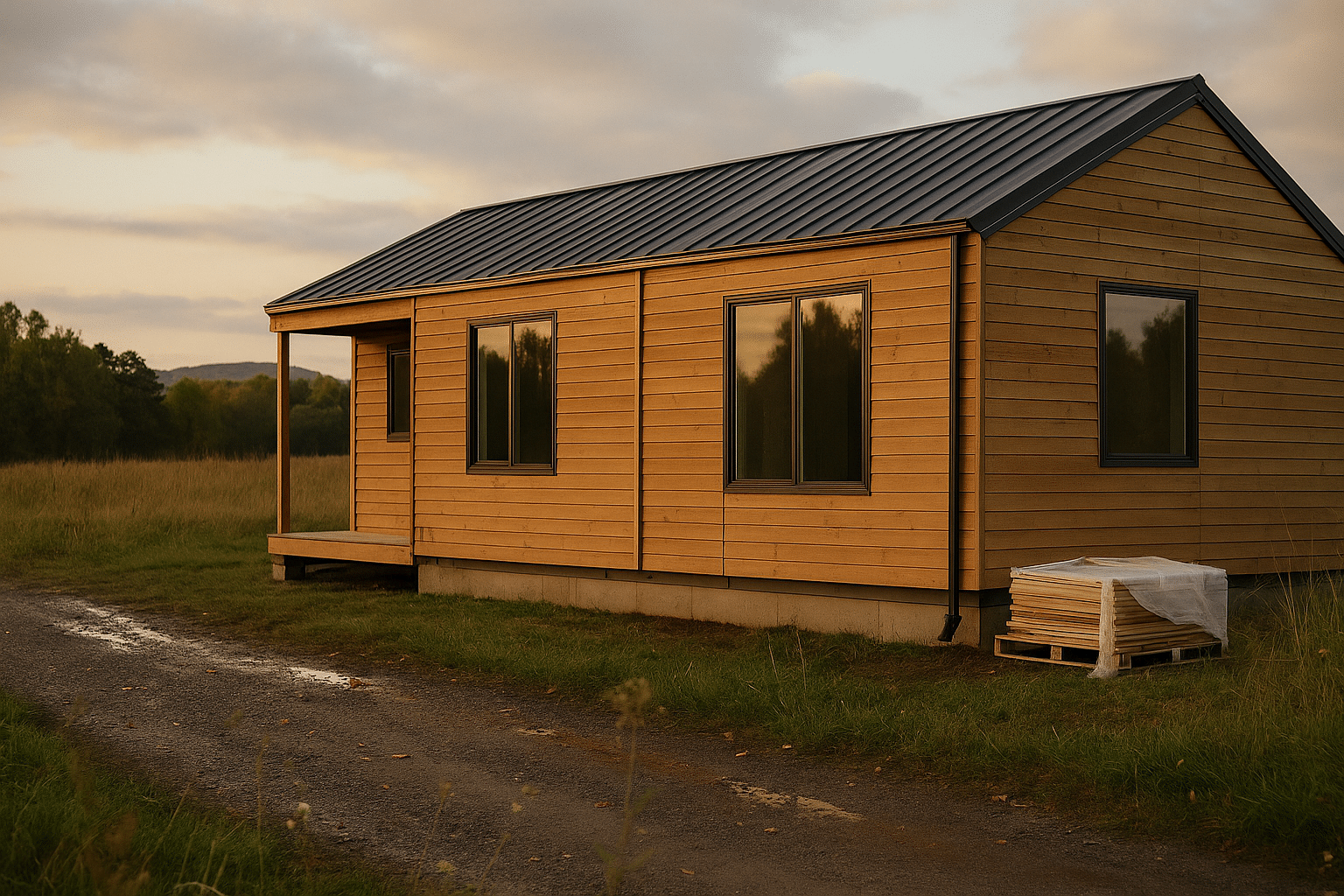

“Prefab” is a broad umbrella for homes whose major components are built in a factory and then transported to a site for assembly. The approach compresses weather exposure, standardizes workmanship, and coordinates trades under one roof. Within that umbrella are several distinct paths, each with its own logic and level of on‑site work. Knowing which one matches your priorities—speed, cost control, or design flexibility—helps you make choices that translate from brochure to lived reality.

Modular homes are fabricated as volumetric boxes (modules) complete with structural framing, insulation, interior finishes, and often mechanical rough‑ins. These modules travel by truck, arrive on a prepared foundation, and are craned into place like building blocks. Because they must withstand transport, modules are typically engineered with robust framing and extra fastening, a strength that can improve long‑term rigidity. Once set, crews connect utilities, seal joints, complete exterior cladding, and finish the interior seams. A comparable option is panelized construction: wall and roof panels are built in a factory, shipped flat, and assembled on site. Panels offer design flexibility—angles, openings, and varying wall thicknesses—while still capturing factory precision.

Manufactured homes, by contrast, are built to a national manufactured housing standard and are typically delivered on a steel chassis. Some are installed on permanent foundations and titled as real property, while others remain movable and may be financed and insured differently. Kit homes round out the category: factories produce precut components with detailed plans, and a local builder—or ambitious owner—handles the assembly. Each path has trade‑offs:

– Modular: faster enclosure and high finish integration; limited by transport dimensions and crane access.

– Panelized: flexibility in form and material choices; more on‑site coordination required.

– Manufactured: lower entry price; siting and financing can be more constrained depending on local rules.

– Kit: cost transparency and DIY potential; schedule and quality depend on the skill of the assembly team.

Because transport dictates dimensions, modules are often designed within roadway limits—commonly around 12–16 feet wide per module in many regions, plus height constraints that consider bridges and power lines. Architects and manufacturers use those limits creatively: stacking modules for clerestory light, offsetting boxes to carve porches, and combining panelized roofs for generous spans. The takeaway is simple: prefab is not one thing. It’s a toolkit of methods you can assemble to fit your site, style, and budget.

Cost, Timeline, and Quality: What to Expect

Prefab shines when you want predictable workflows. Factory production runs in parallel with site preparation, shortening the calendar without rushing the trades. A typical modular or panelized project might follow this arc: design and engineering (4–12 weeks), permitting (variable by jurisdiction), factory fabrication (4–10 weeks), site work and foundation (often parallel), set day (1–3 days), and finish work (4–10 weeks). The total can land in the 4–9 month range for many projects, compared with 9–18 months for a conventional build in similar markets. Weather risk is reduced because the critical carpentry happens under a roof; rain delays mainly affect foundation and exterior finish stages.

Budgeting benefits from clearer line items. While numbers vary by region, finish level, and site complexity, a common way to think about cost is:

– Factory base price: typically quoted per square foot for modules or panels (for example, a wide range such as $90–$180/sf).

– Site work: excavation, utilities, driveway, foundation, and landscaping ($40–$100/sf equivalent, highly site specific).

– Transport and set: trucking, escort vehicles where required, and crane time ($10–$30/sf equivalent depending on distance and lift complexity).

– Soft costs: design, engineering, surveys, permits, and inspections (often 10–20% of construction).

– Contingency: 5–10% for surprises like rock excavation or utility upgrades.

Quality control is where factory methods quietly build value. Dimensional lumber is cut by jigs; fasteners are placed to a consistent pattern; insulation is installed in a dry, clean environment. Factory teams repeat details daily, which reduces variability and rework. Material waste can drop significantly compared with site‑built practices because off‑cuts are easily reused on the next unit, and inventory is managed centrally. Fewer trips to the hardware store, fewer weather‑damaged materials, and tighter coordination translate into steadier outcomes. Potential pitfalls still exist: inaccurate site surveys, underestimating crane access, or late design changes can ripple through the schedule. The antidote is early coordination—aligning the factory drawings with the survey, utility plan, and foundation details before the production run.

Think of prefab costs as a pie you can see before it’s baked. When the pieces are visible—factory scope versus local builder scope—you’re better positioned to compare bids and make trade‑offs. Upgrading insulation or windows in the factory phase can be cost‑effective, while specialty site finishes may be easier to source locally. The right blend depends on your climate, goals, and how much you value an earlier move‑in date.

Design, Materials, and Energy Performance

Prefab does not limit creativity; it asks for disciplined creativity. Modules and panels reward designs that respect transport and lifting realities while still composing spaces with light, proportion, and flow. For example, aligning kitchen and bath stacks between modules simplifies plumbing connections, and using panelized roof systems over modular boxes creates open living areas with longer spans. Exterior expression can range from wood siding with natural grain to fiber‑cement panels or metal cladding with a soft patina. Inside, careful seam placement—behind cabinetry, along shadow lines, or within built‑ins—makes module joints disappear into the architecture.

Energy performance is a natural fit for factory precision. Airtightness benefits from continuous sheathing and tape applied in controlled conditions; typical airtightness levels of 1.0–3.0 ACH50 are achievable with standard practice, and high‑performance targets near 0.6 ACH50 are within reach when details are prioritized. Wall assemblies often start at R‑21 to R‑30, with roof values in the R‑38 to R‑60 range depending on climate. Pair those with high‑performance windows (low U‑factors and thoughtful solar heat gain) and balanced ventilation, and you have a home that’s comfortable, quiet, and efficient. Because factories repeat assemblies, you can standardize smart details: continuous exterior insulation, insulated headers, and thermal‑bridge‑aware framing patterns.

Sustainability extends beyond energy bills. Material selection can trim embodied carbon by favoring wood‑rich assemblies, engineered timber, and mineral wool or cellulose insulation. Low‑VOC finishes improve indoor air quality from day one. Prefab’s waste reduction and controlled storage keep materials dry, preventing mold and preserving performance. If you’re planning for solar, pre‑wire chases and panel standoffs in the factory; if you’re adding battery storage later, reserve space in a mechanical room and provide conduit runs to the main service equipment.

Here are design moves that regularly add value without inflating complexity:

– Group wet rooms between modules to simplify connections and reduce field coordination.

– Use a panelized roof or site‑built roof trusses to open great rooms without oversized crane lifts.

– Place horizontal seams at sill or header heights and hide them with trim reveals for a clean finish.

– Orient glazing for winter sun and summer shade, and specify overhangs that fit your latitude.

– Standardize on a compact, efficient mechanical system, such as an all‑electric heat pump paired with balanced ventilation.

Performance is ultimately a set of choices, not an accident. Prefab gives you the chance to make those choices early, lock them into repeatable assemblies, and receive a home that performs as drawn—not just as hoped.

The Process: Land, Permits, Logistics, and Inspections

Every successful prefab build starts with the site. Zoning dictates setbacks, height, and allowable uses; utilities determine how far you must trench and what capacity is available; soils influence foundation type and cost. Begin with a survey that marks property lines and topography, then order a geotechnical report if slopes, expansive clays, or high water tables are in play. With that information, your designer and manufacturer can coordinate module dimensions with the foundation plan, mechanical layout, and crane access path.

Permitting follows local rules, but prefab splits responsibilities: the factory typically provides engineered drawings and third‑party inspections for the off‑site components, while local authorities review foundations, site work, and final occupancy. Expect plan review to scrutinize energy compliance, egress, structural loads, and utility connections. For transport, modules may require oversize permits, travel at specified hours, and need escort vehicles; tight turns, low wires, or narrow bridges must be mapped in advance. On set day, neighbors appreciate notice about temporary road closures and crane positioning.

A coordinated schedule keeps momentum:

– Preconstruction: survey, soils report, preliminary design, and rough cost plan.

– Approvals: detailed drawings, structural calcs, energy forms, and permit submittal.

– Parallel work: factory fabrication while the foundation, utilities, and driveway are built.

– Delivery and set: modules craned onto the foundation or panels erected with a crew lead.

– Finish and inspection: interior seam work, exterior cladding, utility commissioning, blower‑door testing, and final occupancy.

Logistics deserve a dedicated walk‑through. Trace the route a 60‑ to 70‑foot truck will take from highway to site; identify where the crane will sit and how outriggers will be supported; verify that the foundation elevations match the factory drawings to the inch. Small misalignments slow crews and create rework. Weather matters here too: while modules are wrapped for transport, you still want a calm, dry day for the crane. Keep a contingency plan for gusty winds, backup rigging, and protective coverings for exposed seams.

Inspections are a two‑tiered process. Off‑site work is certified before shipping; on‑site work is inspected just like any other home—footings, foundation, framing connections, mechanical, electrical, plumbing, and final. If your jurisdiction allows, schedule the blower‑door test and insulation inspection before drywall closes critical areas. The result is a documented record that your home meets both the factory’s specifications and local code requirements.

From Idea to Keys: A Practical Conclusion for Future Owners

Prefab rewards clarity of goals. If your priorities include a reliable schedule, consistent quality, and the option to front‑load performance decisions, factory‑built methods deliver strong alignment. The ownership journey, however, begins well before set day and continues long after move‑in. Financing is a good example: modular and panelized projects on permanent foundations are typically financed like conventional builds through construction‑to‑permanent loans, with disbursements tied to milestones (foundation, delivery, set, completion). Manufactured homes can follow a different path if not affixed as real property, sometimes involving chattel loans; permanence and land ownership often unlock broader lending and insurance choices.

Insurance usually reflects how the home is titled and built. A modular home finished on a permanent foundation and meeting local building codes generally fits conventional homeowners policies. Manufactured homes may require specialized coverage, with premiums influenced by location, tie‑down systems, and proximity to services. Resale values depend on local markets, but appraisers often treat modular homes similarly to site‑built comparables once permanently affixed and finished to a similar standard. The narrative that factory‑built automatically depreciates is too simple; quality of construction, neighborhood context, and ongoing maintenance are the real drivers.

Speaking of maintenance, a few recurring tasks keep a prefab home in top form:

– Inspect and reseal exterior joints at module seams and penetrations every 2–3 years.

– Maintain roof flashing and gutters, especially near crane‑set seams and parapets.

– Monitor crawlspace or basement humidity and ensure drainage stays clear.

– Replace filters on ventilation and heating equipment on the recommended schedule.

– Recheck transport tie points (if accessible) after the first seasonal cycles.

For homeowners, small developers, and design‑forward buyers, the path is straightforward: assemble a team that knows both factory and field, define the scope line between manufacturer and local builder, and align design decisions with climate and site. Tour completed projects, ask for airtightness results and spec sheets, and read the fine print on warranties and schedules. Prefab is not a shortcut; it’s a more organized route. When you treat it that way—planning carefully, deciding early, and coordinating honestly—you trade uncertainty for momentum and turn a sequence of deliveries, lifts, and checklists into a comfortable, enduring home.